Earn Rewards with our No Annual Fee Credit Cards

Use anywhere Visa is Accepted

Banking

See why we’ve got the banks beat!

Primary Savings

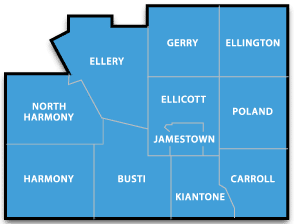

Your primary Savings Account is the key to Credit Union membership! Anyone who lives, works, worships, or goes to school in our service area can join the Credit Union by opening a Share Account.

Share Checking

No monthly fees, overdraft protection, and no minimum balance! What are you waiting for?

Term Share Certificates

Whether you have short or long-term savings goals, you should consider the benefit of opening a Term Share Certificate with us. With a guaranteed fixed rate and federally insured, you can’t loose!

Money Market Account

Money Market Accounts offer the advantage of higher yields without locking up your money. Watch your money grow as the dividends are compounded monthly.

Bank Local

Do you want to know that you are more than just a number or a deposit slip? That's one of the many reasons why we're one up on banking! Affinity One Federal Credit Union was organized in 1948 and today we serve over 4,300 of your friends and neighbors in southern Chautauqua County.

Loans

At Affinity One FCU we offer a number of different consumer loan options to meet all your financing needs. From small purchases to home improvements to a new or used vehicle, you’re going to love our competitive rates.

Signature Select Loans

Signature loans are personal loans used by our members for small purchases such as computers, home improvements, vacations or unexpected expenses.

Personal Loans

A personal loan is a type of loan that uses collateral already owned by you to secure the loan.

Share Secure Loans

A low-cost, flexible term loan is a great way to re-establish or re-build your credit.

Vehicle Loans

Let us help make that new, or used automobile, motorcycle or recreational vehicle a reality!

Credit Cards

Affinity One goes one up on banks again by providing members with credit card options to fit every lifestyle. Our cards have no annual fee and cash advances are available at the same rate as purchases!

Your money, wherever you are

Over 30 No Fee Locations

We have an ATM located at our Lakewood branch and an agreement with M&T Bank for our members to use the M&T ATMs throughout the country without paying a fee.

Affinity One FCU

Lakewood branch

10 Sessions Ave.

Lakewood, NY 14750

Directions

or

Find a No Fee M&T Bank ATM near you

Two Locations to Serve You Better

We have an ATM located at our Lakewood branch and an agreement with M&T Bank for our members to use M&T ATMs throughout the country without paying a fee.

Affinity One Federal Credit Union – Jamestown Branch

545 E. Second St

Jamestown, NY 14701

Phone: +1(716)483-2798

Fax: +1(716)483-6136

Monday | 8:30 AM – 4:00 PM |

Tuesday | 8:30 AM – 4:00 PM |

Wednesday | 8:30 AM – 4:00 PM |

Thursday | 8:30 AM – 4:00 PM |

Friday | 8:30 AM – 4:00 PM |

Saturday | Closed |

Sunday | Closed |

Affinity One Federal Credit Union – Lakewood Branch

10 Session Ave

Lakewood, NY 14750

Phone: +1(716)483-2265

Fax: +1(716)483-2266

Monday | 8:30 AM – 4:00 PM |

Tuesday | 8:30 AM – 4:00 PM |

Wednesday | 8:30 AM – 4:00 PM |

Thursday | 8:30 AM – 5:00 PM |

Friday | 8:30 AM – 5:00 PM |

Saturday | 9:00 AM – 12:00 PM |

Sunday | Closed |

ATM AVAILBLE DURING OPEN HOURS

Become a Member

If you or a member of your family live, work, worship or go to school in our service area, you can become a member. It's that simple.

Jamestown • Busti • Carrol • Ellicott • Ellington • Gerry • Harmony • Kiantone • North Harmony • Poland

Hear What Our Great Customers have to Say

The staff, Michelle especially, at the Lakewood branch of Affinity are the most friendly and helpful people that I have ever worked with in a banking capacity.

I really like this credit union, I've been with them for over a year now not had any problems and feel that my money is safe and secure. Thank you all for everything! 🙂

Affinity One made it so easy to refinance our mortgage! Their low closing fees saved us thousands